How to Trade Futures on XT.com

What are Perpetual Futures Contracts?

A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price and date in the future. These assets can range from commodities such as gold or oil, to financial instruments like cryptocurrencies or stocks. This type of contract serves as a powerful tool to both protect against potential losses and to secure profits.Perpetual futures contracts are a type of derivative that allows traders to speculate on the future price of an underlying asset without actually owning it. Unlike regular futures contracts that have a set expiration date, perpetual futures contracts do not expire. This means that traders can hold their positions for as long as they want, allowing them to take advantage of long-term market trends and potentially earn significant profits. Additionally, perpetual futures contracts often have unique features like funding rates, which help keep their price in line with the underlying asset.

Perpetual futures do not have settlement periods. You can hold a trade for as long as you want, as long as you have enough margin to keep it open. For example, if you buy BTC/USDT perpetual at $30,000, you will not be bound by any contract expiry time. You can close the trade and secure your profit (or take the loss) when you want. Trading in perpetual futures is not allowed in the U.S. But the market for perpetual futures is sizable. Almost 75% of cryptocurrency trading worldwide last year was in perpetual futures.

Overall, perpetual futures contracts can be a useful tool for traders looking to gain exposure to the cryptocurrency markets, but they also come with significant risks and should be used with caution.

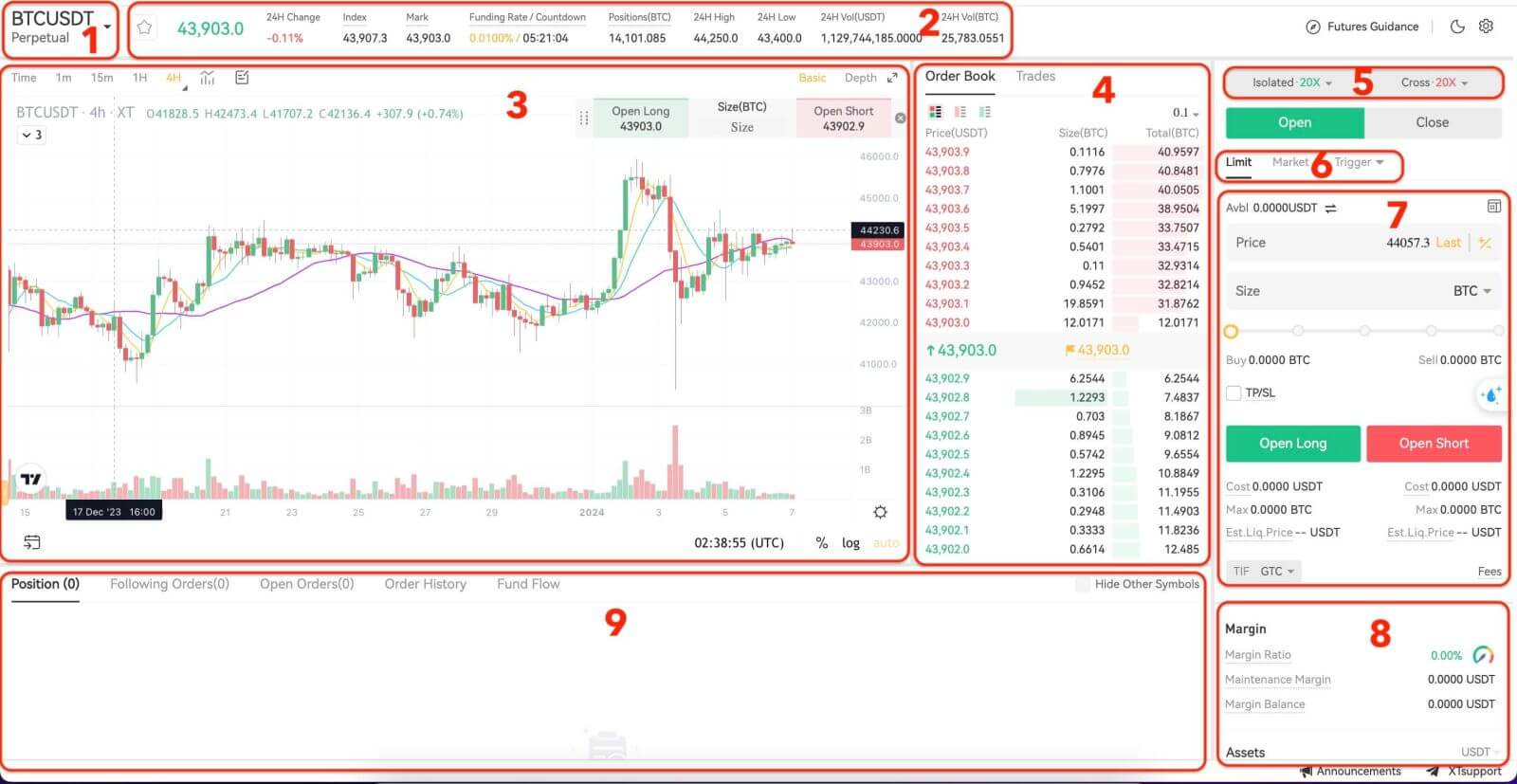

- Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

- Trading Data and Funding Rate: : Current price, highest price, lowest price, increase/decrease rate, and trading volume information within 24 hours. Display the current and next funding rate.

- TradingView Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

- Orderbook and Transaction Data: Display current order book order book and real-time transaction order information.

- Position and Leverage: Switching of position mode and leverage multiplier.

- Order type: Users can choose from a limit order, market order and trigger order.

- Operation panel: Allow users to make fund transfers and place orders.

- Asset information: Current account’s margin and assets, profit and loss information.

- Position and Order information: Current position, current orders, historical orders and transaction history.

How to Trade USDT-M Perpetual Futures on XT.com (Web)

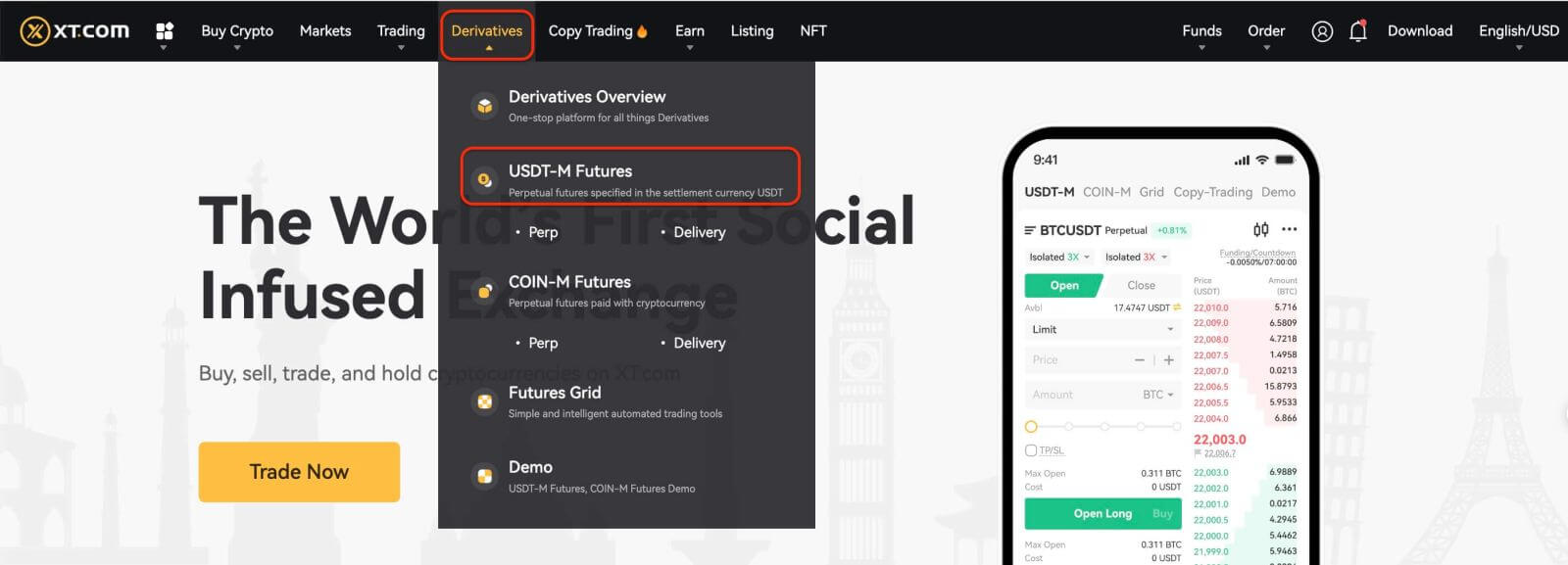

1. Log in to XT.com website and navigate to the "Futures" section by clicking the tab at the top of the page.

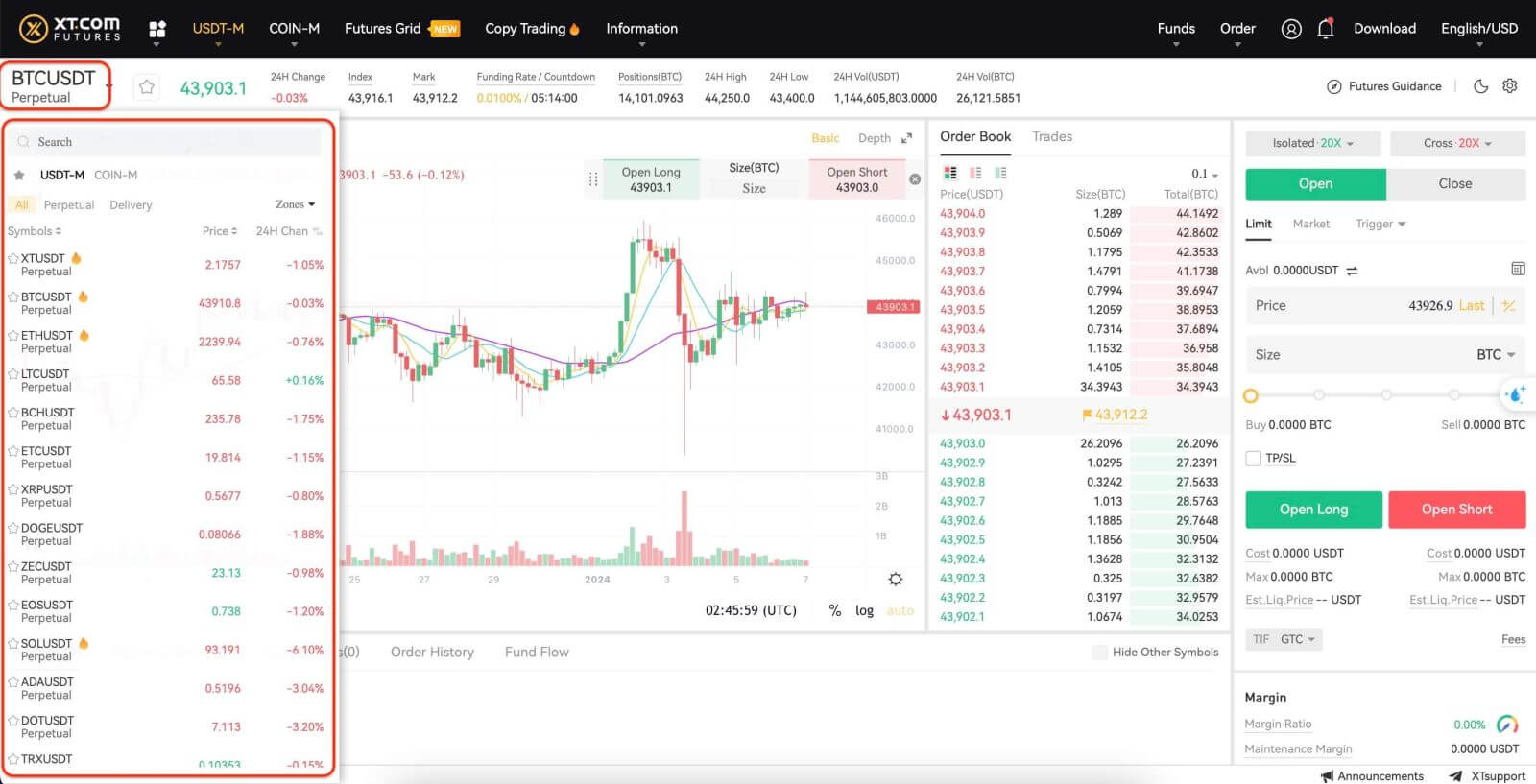

2. On the left-hand side, select BTCUSDT from the list of futures.

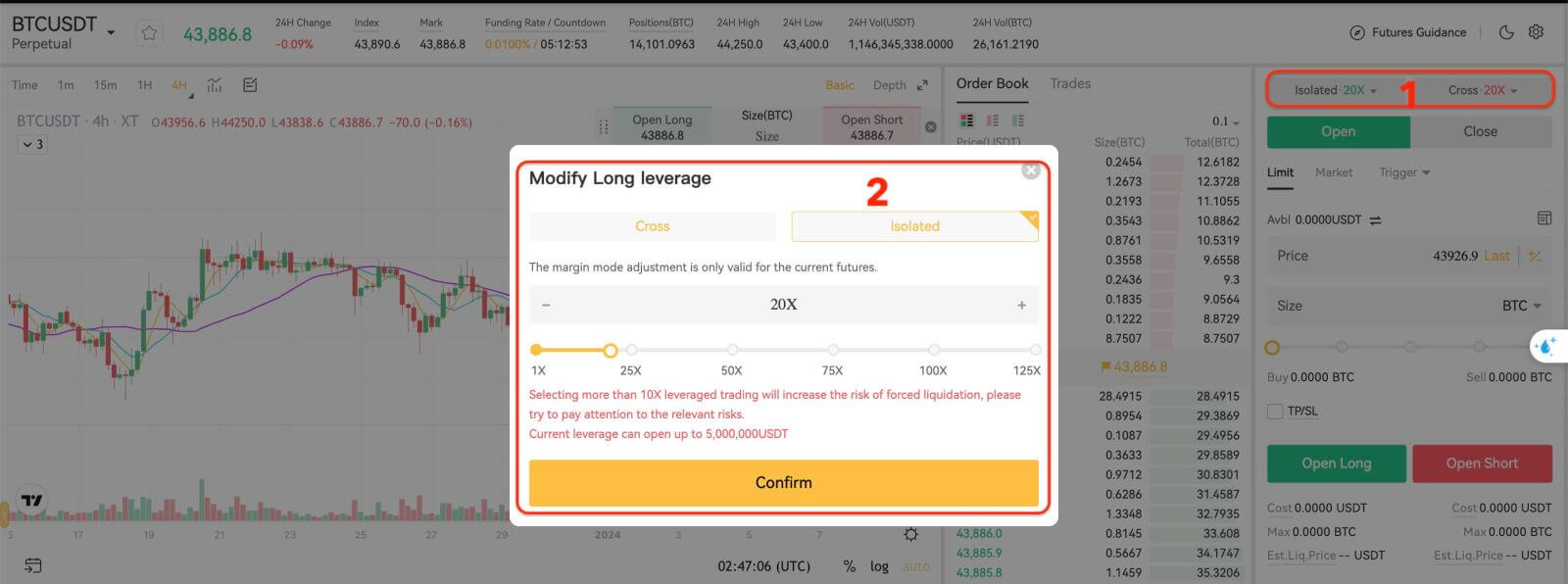

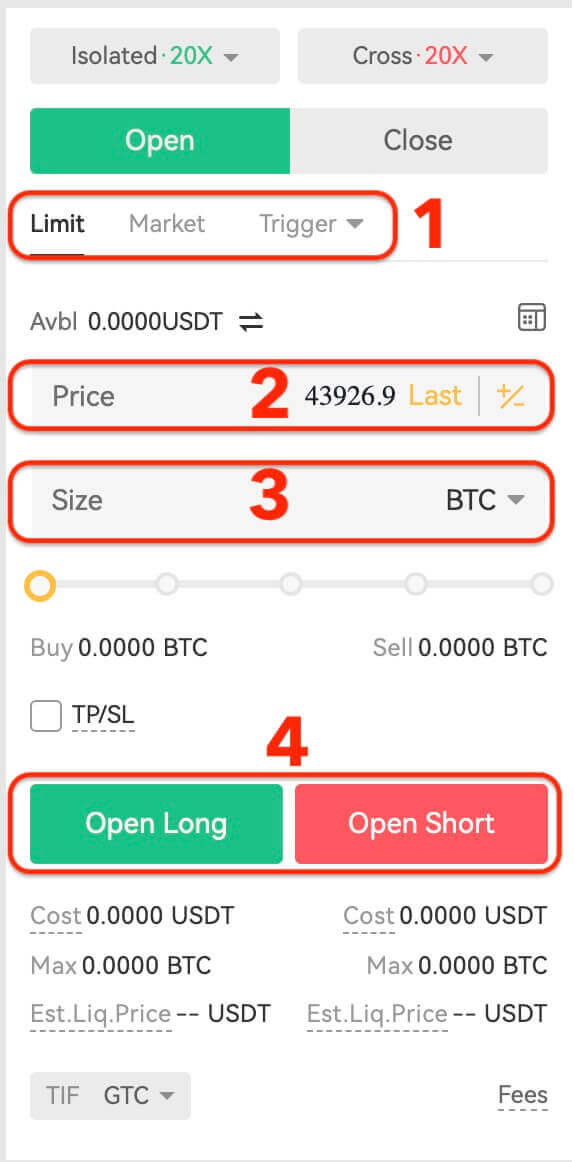

3. Choose "Position by Position" on the right to switch position modes. Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples—please check the specific product details for more information.

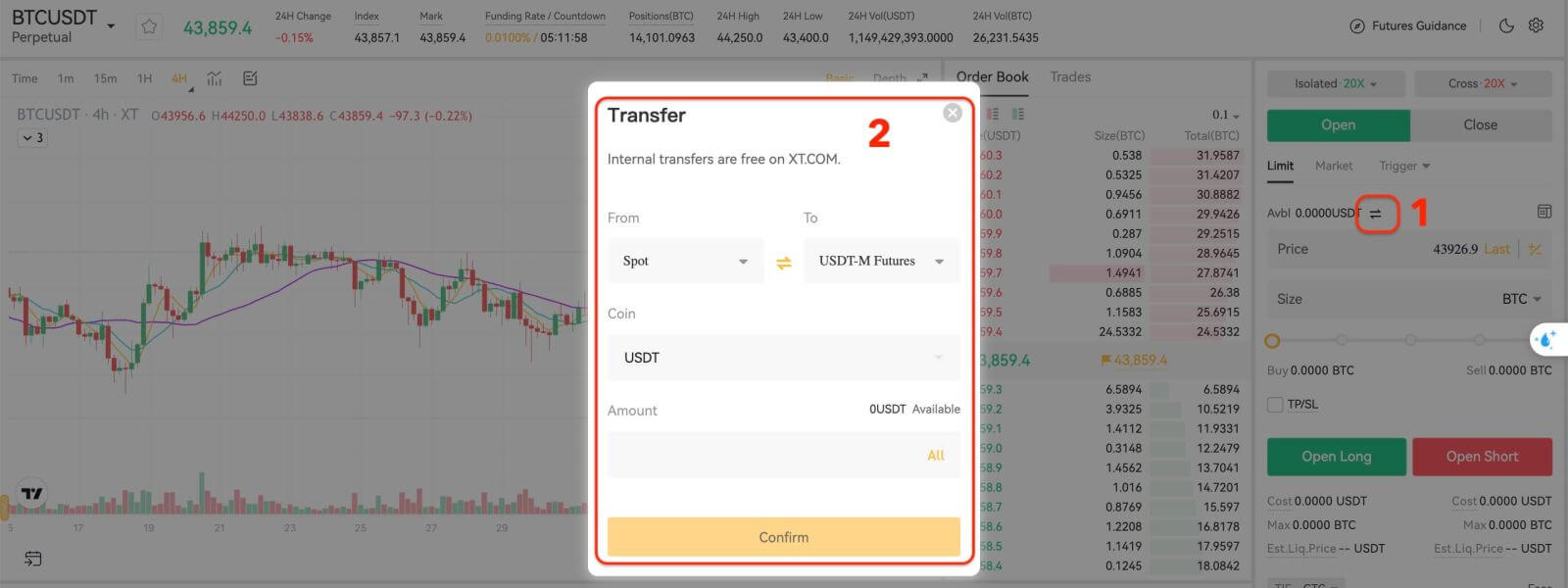

4. Click the small arrow button on the right to access the transfer menu. Enter the desired amount for transferring funds from the spot account to the futures account and confirm.

5. To open a position, users can choose between three options: Limit Order, Market Order, and Trigger Order. Enter the order price and quantity and click Open.

- Limit Order: Users set the buying or selling price by themselves. The order will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for the transaction in the order book;

- Market Order: Market order refers to the transaction without setting the buying price or selling price. The system will complete the transaction according to the latest market price when placing the order, and the user only needs to enter the amount of the order to be placed.

- Trigger Order: Users are required to set a trigger price, order price and amount. Only when the latest market price reaches the trigger price, the order will be placed as a limit order with the price and amount set before.

6. After placing your order, view it under "Open Orders" at the bottom of the page. You can cancel orders before they’re filled. Once filled, find them under "Position".

7. To close your position, click "Close" under the Operation column.

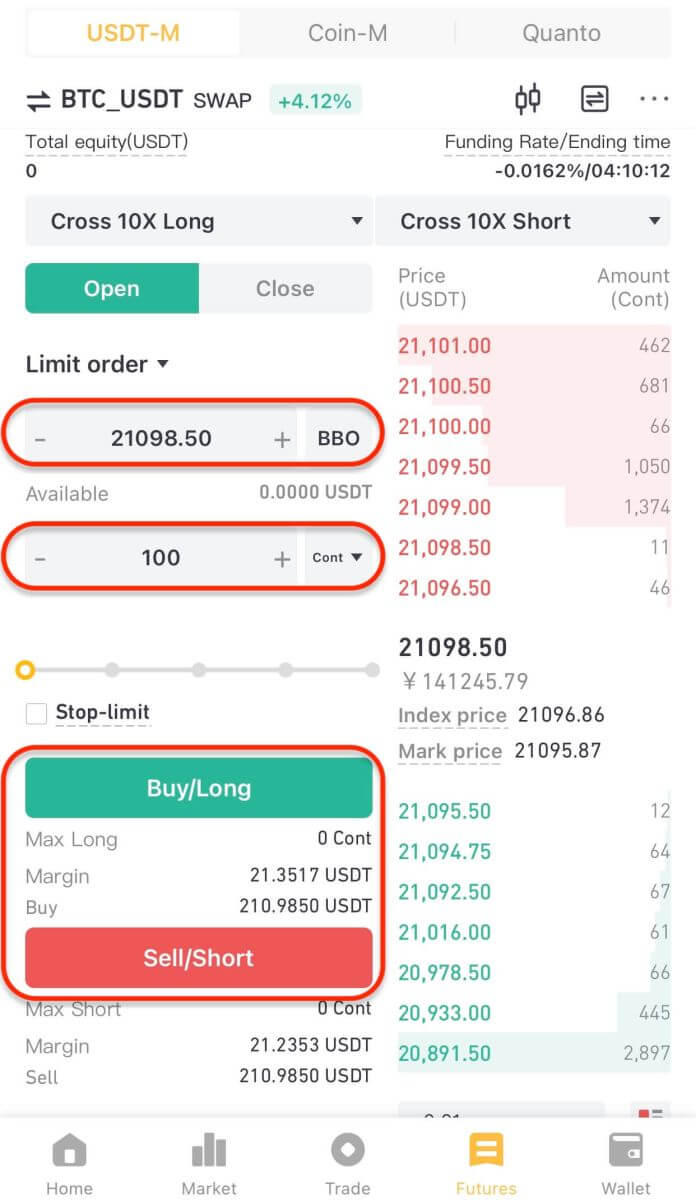

How to Trade USDT-M Perpetual Futures on XT.com (App)

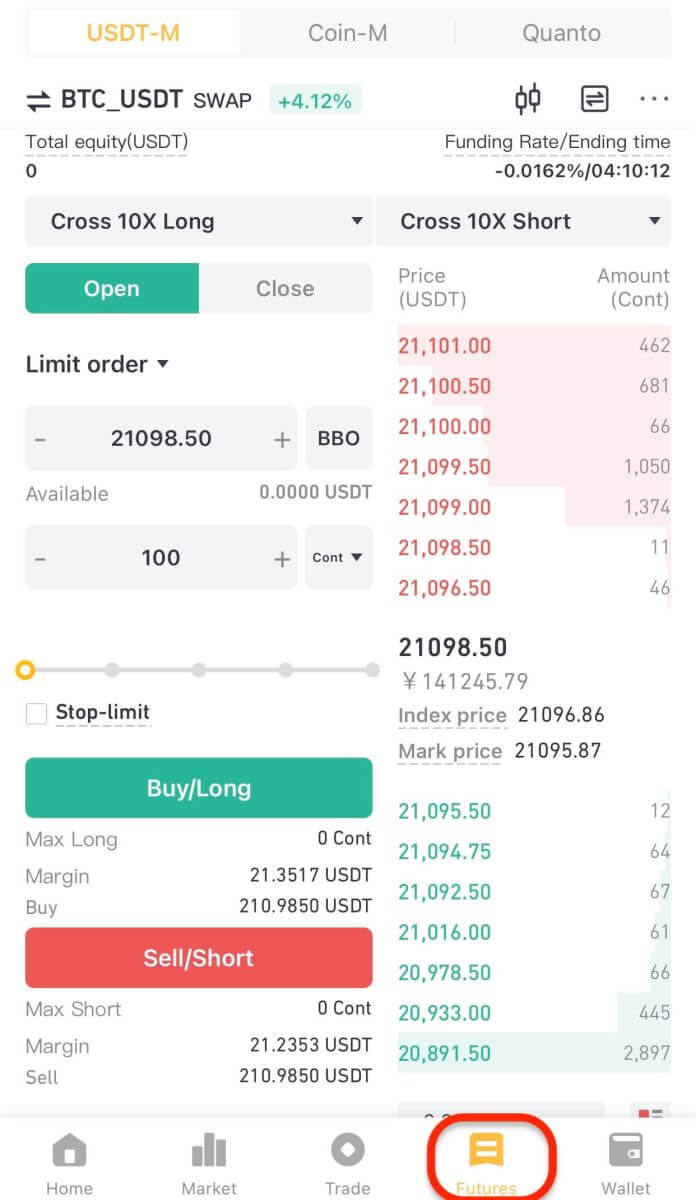

1. Sign in to your XT.com account using the mobile application and access the "Futures" section located at the bottom of the screen.

2. Tap on BTC/USDT situated at the top left to switch between different trading pairs. Utilize the search bar or directly select from the listed options to find the desired futures for trading.

3. Choose the margin mode and adjust the leverage settings according to your preference.

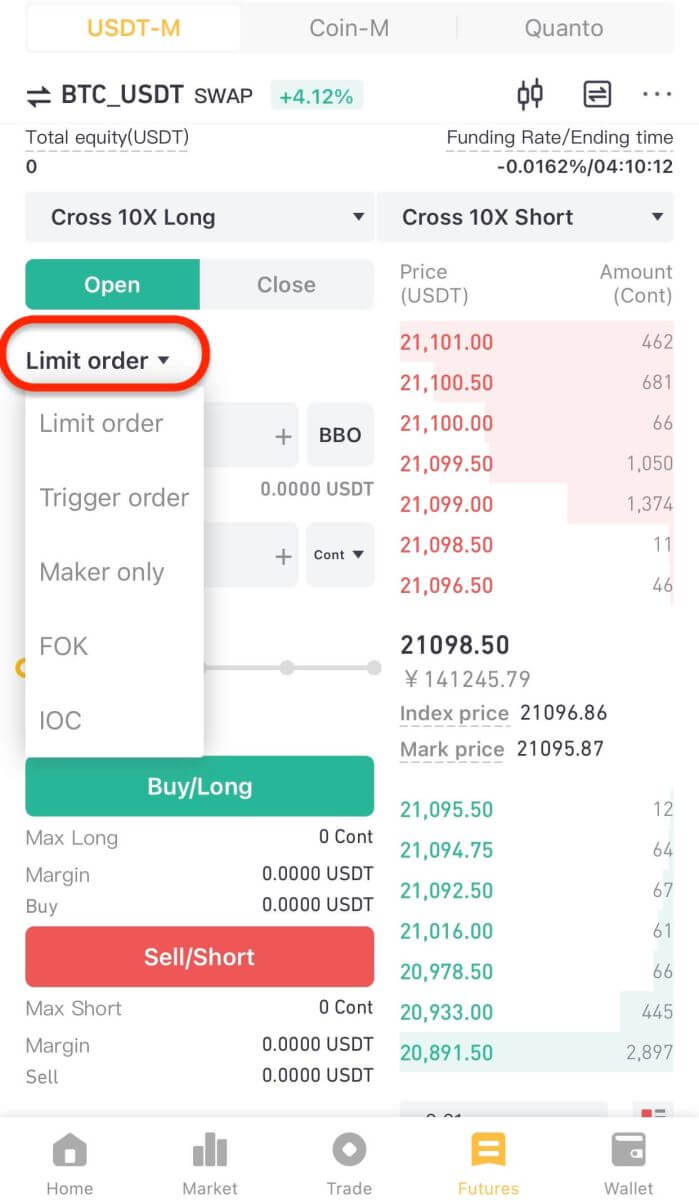

4. On the right side of the screen, place your order. For a limit order, enter the price and amount; for a market order, input only the amount. Tap "Buy" to initiate a long position or "Sell" for a short position.

5. Once the order is placed, if it isn’t filled immediately, it will appear in "Open Orders." Users have the option to tap "[Cancel]" to revoke pending orders. Fulfilled orders will be located under "Positions".

6. Under "Positions," tap "Close," then enter the price and amount required to close a position.

Frequently Asked Questions (FAQ)

What are the main features of perpetual futures contracts trading?

While perpetual futures contracts are relatively new to the trading world, they have quickly gained popularity among traders looking for a flexible and versatile way to engage in speculative trading. Whether you are a seasoned trader or just starting out, perpetual futures contracts are definitely worth learning more about.Initial margin

- Initial margin is the minimum amount of funds required to be deposited into a trading account to open a new position. This margin is used to ensure that traders can meet their obligations if the market moves against them, and it also acts as a buffer against volatile price movements. While initial margin requirements vary between exchanges, they typically represent a fraction of the total trade value. Therefore, it is crucial to manage initial margin levels carefully to avoid liquidation or margin calls. It is also advisable to keep track of the margin requirements and regulations on different platforms to optimize your trading experience.

Maintenance margin

- Maintenance margin is the minimum amount of funds that an investor must maintain in their account to keep their position open. In simple terms, it is the amount of money required to hold a position in a perpetual futures contract. This is done to protect both the exchange and the investor from potential losses. If the investor fails to meet the maintenance margin, then the crypto derivatives exchange may close their position or take other actions to ensure the remaining funds are sufficient to cover the losses.

Liquidation

- Liquidation refers to the process of closing out a trader’s position when their available margin falls below a certain threshold. The purpose of liquidation is to mitigate risk and ensure that traders do not lose more than they can afford. For traders, it’s important to keep a close eye on their margin levels to avoid being liquidated. On the flip side, liquidation can present an opportunity for other traders to capitalize on a price drop by buying in at a lower price.

Funding rate

- Funding rate is a mechanism for ensuring that the price of the perpetual futures contracts reflects the underlying price of Bitcoin. When the funding rate is positive, long positions pay shorts, while when it’s negative, shorts pay longs. Understanding funding rates is essential as it can impact an investor’s profit and loss, making it crucial to keep an eye on funding rates when trading perpetual futures (such as perpetual bitcoin futures, perpetual ether futures).

Mark price

- Mark price refers to the fair value price of an asset, which is estimated by taking into account the bid and ask prices from different trading platforms. This price is used to prevent market manipulation by ensuring that the futures contract’s price remains in line with the underlying asset’s price. This means that if the market price of cryptocurrency changes, the mark price of the futures contracts will also adjust accordingly, which can help you make more precise trading decisions.

PnL

- PnL stands for “profit and loss,” and it’s a way of measuring the potential gains or losses that traders can experience when buying and selling perpetual futures contracts (such as perpetual bitcoin contracts, perpetual ether contracts). Essentially, PnL is a calculation of the difference between the entry price and the exit price of a trade, taking into account any fees or funding costs associated with the contract.

Insurance Fund

- Insurance fund in perpetual futures (such as perpetual BTC contracts, perpetual ETH contracts) serves as a protection pool that helps safeguard traders against potential losses due to sudden market fluctuations. In other words, if the market experiences a sudden and unexpected drop, the insurance fund acts as a buffer to help cover any losses and prevent traders from having to liquidate their positions. It’s an important safety net in what can be a volatile and unpredictable market, and is just one of the ways that trading in perpetual futures is evolving to meet the needs of its users.

Auto-deleveraging

- Auto-deleveraging is essentially a risk management mechanism that ensures that trading positions are closed in case of insufficient margin funds. In simpler terms, it means that if a trader’s position moves against them and their margin balance falls below the required maintenance, the crypto derivatives exchange will automatically deleverage their position. While this may sound like a bad thing, it’s actually a preventative measure that protects traders from losing more funds than they can afford. It’s important for anyone trading perpetual futures (such as perpetual bitcoin futures contracts, perpetual ether futures contracts) to understand how auto-deleveraging can affect their positions and to use it as an opportunity to assess and improve their risk management strategies.

How do perpetual futures contracts work?

Let’s take a hypothetical example to understand how perpetual futures work. Assume that a trader has some BTC. When they purchase the contract, they either want this sum to increase in line with the price of BTC/USDT or move in the opposite direction when they sell the contract. Considering that each contract is worth $1, if they purchase one contract at the price of $50.50, they must pay $1 in BTC. Instead, if they sell the contract, they get $1’s worth of BTC at the price they sold it for (it still applies if they sell before they acquire).It is important to note that the trader is purchasing contracts, not BTC or dollars. So, why should you trade crypto perpetual futures? And how can it be certain that the contract’s price will follow the BTC/USDT price?

The answer is via a funding mechanism. Users with long positions are paid the funding rate (compensated by users with short positions) when the contract price is lower than the price of BTC, giving them an incentive to purchase contracts, causing the contract price to rise and realign with the price of BTC/USDT. Similarly, users with short positions can purchase contracts to close their positions, which will likely cause the price of the contract to increase to match the price of BTC.

In contrast to this situation, the opposite occurs when the price of the contract is higher than the price of BTC - i.e., users with long positions pay users with short positions, encouraging sellers to sell the contract, which drives its price closer to the price of BTC. The difference between the contract price and the price of BTC determines how much funding rate one will receive or pay.

What are the differences between perpetual futures contracts and traditional futures contracts?

Perpetual futures contracts and traditional futures contracts are two variations of futures trading that bring different advantages and risks to traders and investors. Unlike traditional futures contracts, perpetual futures contracts do not have a set expiry date, which allows traders to hold positions for as long as they want. Secondly, perpetual contracts offer greater flexibility and liquidity in terms of margin requirements and funding costs. Moreover, perpetual futures contracts use innovative mechanisms like funding rates to ensure that the futures price closely tracks the underlying asset’s spot price.However, perpetual contracts also come with unique risks, such as funding costs that can fluctuate as frequently as every 8 hours. Conversely, traditional futures contracts have a fixed expiration date and may require higher margin requirements, which can limit a trader’s flexibility and add uncertainty. Ultimately, which contract to use depends on a trader’s risk tolerance, trading goals, and market conditions.

What are the differences between perpetual futures contracts and margin trading?

Perpetual futures contracts and margin trading are both ways for traders to increase their exposure to the cryptocurrency markets, but there are some key differences between the two.

- Timeframe: Perpetual futures contracts do not have an expiration date, while margin trading is typically done over a shorter timeframe, with traders borrowing funds to open a position for a specific period of time.

- Settlement: Perpetual futures contracts settle based on the index price of the underlying cryptocurrency, while margin trading settles based on the price of the cryptocurrency at the time the position is closed.

- Leverage: Both perpetual futures contracts and margin trading allow traders to use leverage to increase their exposure to the markets. However, perpetual futures contracts typically offer higher levels of leverage than margin trading, which can increase both potential profits and potential losses.

- Fees: Perpetual futures contracts typically have a funding fee that is paid by traders who hold their positions open for an extended period of time. Margin trading, on the other hand, typically involves paying interest on the borrowed funds.

- Collateral: Perpetual futures contracts require traders to deposit a certain amount of cryptocurrency as collateral to open a position, while margin trading requires traders to deposit funds as collateral.